We Are Waukee

At Waukee Community School District, we inspire learners who feel valued, challenged, and prepared to embrace tomorrow’s opportunities.

Enroll NowWaukee CSD News

All News

Featured Events

All EventsWhy Waukee CSD?

We are a leader in academics. We are a vibrant community. We are an exceptional place to learn, work, and thrive.

We are Waukee.

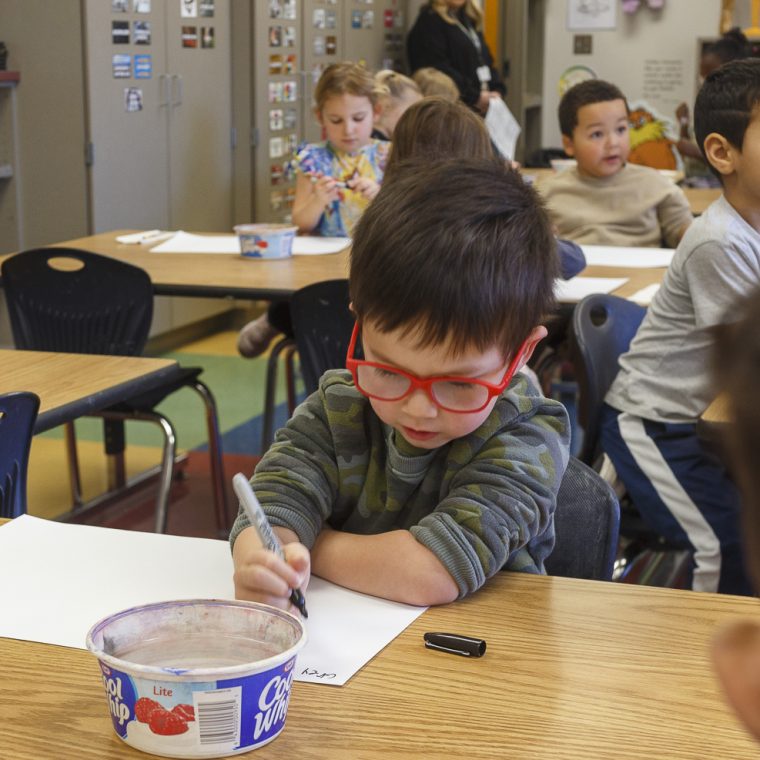

World Class Facilities

Our District features 19 buildings with modern, well-maintained facilities. We prioritize continued improvements, up-to-date technology, and welcoming spaces to offer an exceptional educational environment for our students.

Work-Based Learning

We ensure our graduates will succeed in college, the workplace, and life. Three-quarters of our graduating class participate in work-based learning through our Waukee APEX program, career services, internships, and more.

Innovation

As one of the largest and fastest growing districts in the state, innovation is part of our culture. From augmented reality welders to robotics — we adapt to the changing world of education and prepare our students for a future they can't yet envision.

Endless Opportunities

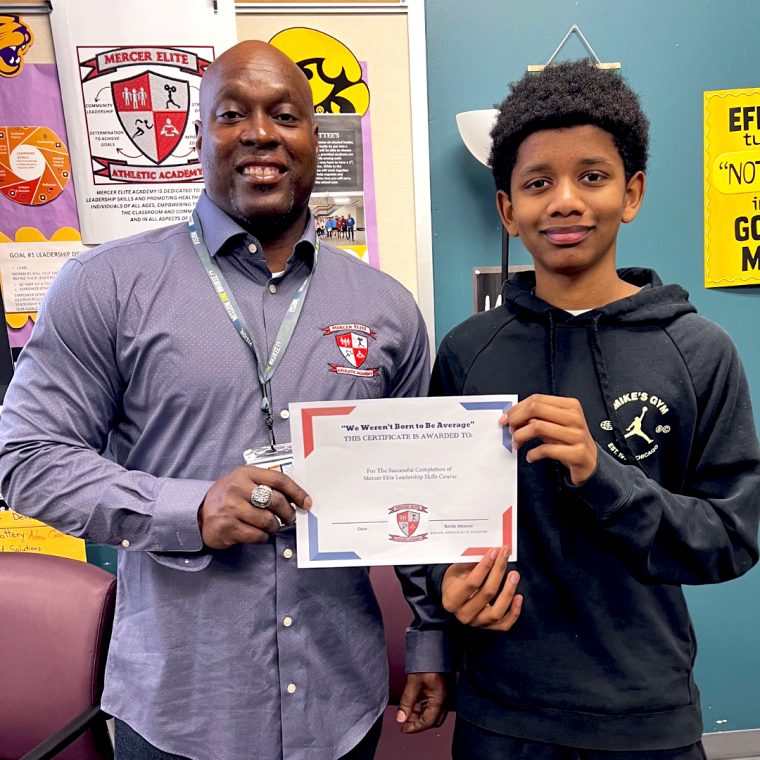

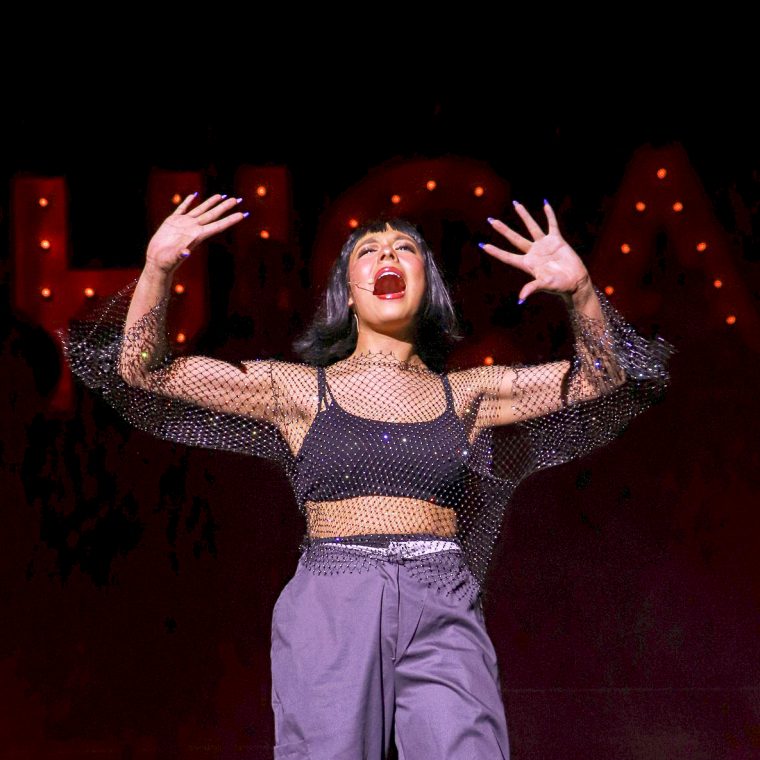

At Waukee CSD, we feel like a small community with the opportunities and amenities of a large district. Every student can explore their interests through athletics, performing arts, publications, clubs, volunteering, and more.

"The APEX program gives students the chance to get real-world work experience in the areas that they are passionate about."

23.5

Average ACT Composite score

50+

National Merit Finalists since 2010

98%

Graduation rate

Portrait of a Graduate

View Our Strategic PlanOur graduates will be prepared with the knowledge and skills necessary for their future success.

Our graduates will be prepared to navigate a complex, ever-changing global society and economy.

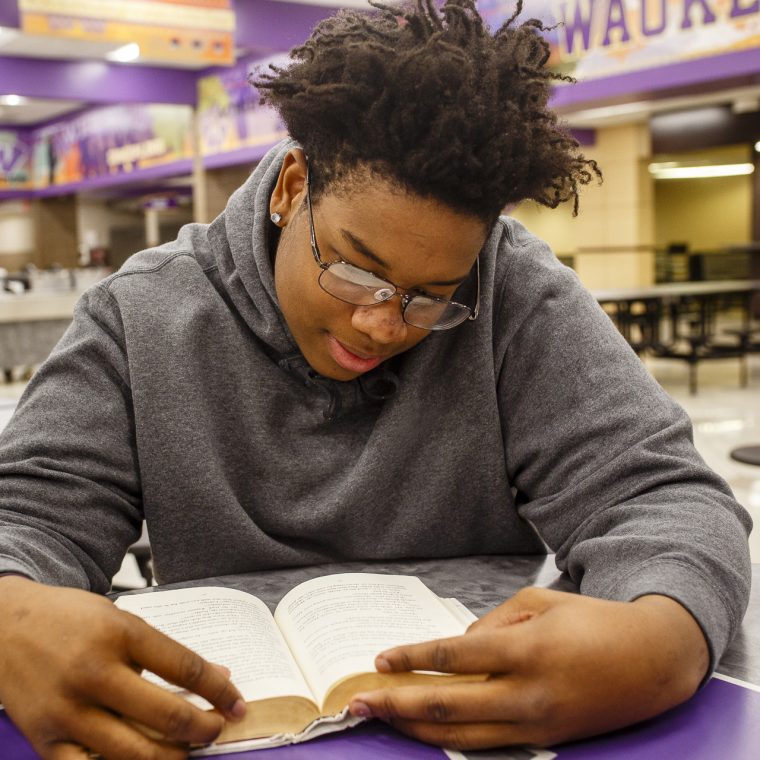

Our graduates will be prepared to be information literate through inquiry, critical thinking, and problem solving.

Our graduates will be prepared with essential health and wellness skills they can continue after graduation.

Our graduates will be prepared to successfully build personal and professional connections in their lives.

Our students will be prepared to succeed beyond high school by articulating and executing a plan.